Fast, Flexible Business Funding—

Built for You.

Bright Funding empowers small, independent businesses with fast, simple access to capital—helping mom‑and‑pop shops and local entrepreneurs thrive without the runaround.

Your Business Matters.

Bright Funding makes capital fast, simple, and human—so you can stop worrying about paperwork and focus on growth.

Why Choose Us?

Because, waiting weeks for capital shouldn’t be the norm.

“I needed funding fast to keep my business running—Bright Funding came through.”

“I thought I was too small to matter, but they proved me wrong.”

“One slow season can crush a small business. Bright gave us breathing room.”

We’ve got you covered.

What Small Business Owners Are Saying.

We’re proud to support the businesses that keep our communities vibrant.

Fill out the form below to contact us!

Our Hours

Weekdays: 9 AM – 5 PM

© Bright Funding Inc. – NMLS ID #2705538. All Rights Reserved.

Our Mission.

Bright Funding was founded on one simple idea: business owners deserve a faster, fairer way to access capital.

Who We’ve Helped.

Our Promise To You.

No hidden fees.

Transparent offers tailored to your business.

Real people, ready to help you succeed.

We combine human insight with smart underwriting to deliver flexible funding options—without the

stress or delays of traditional lenders.

Our Partners.

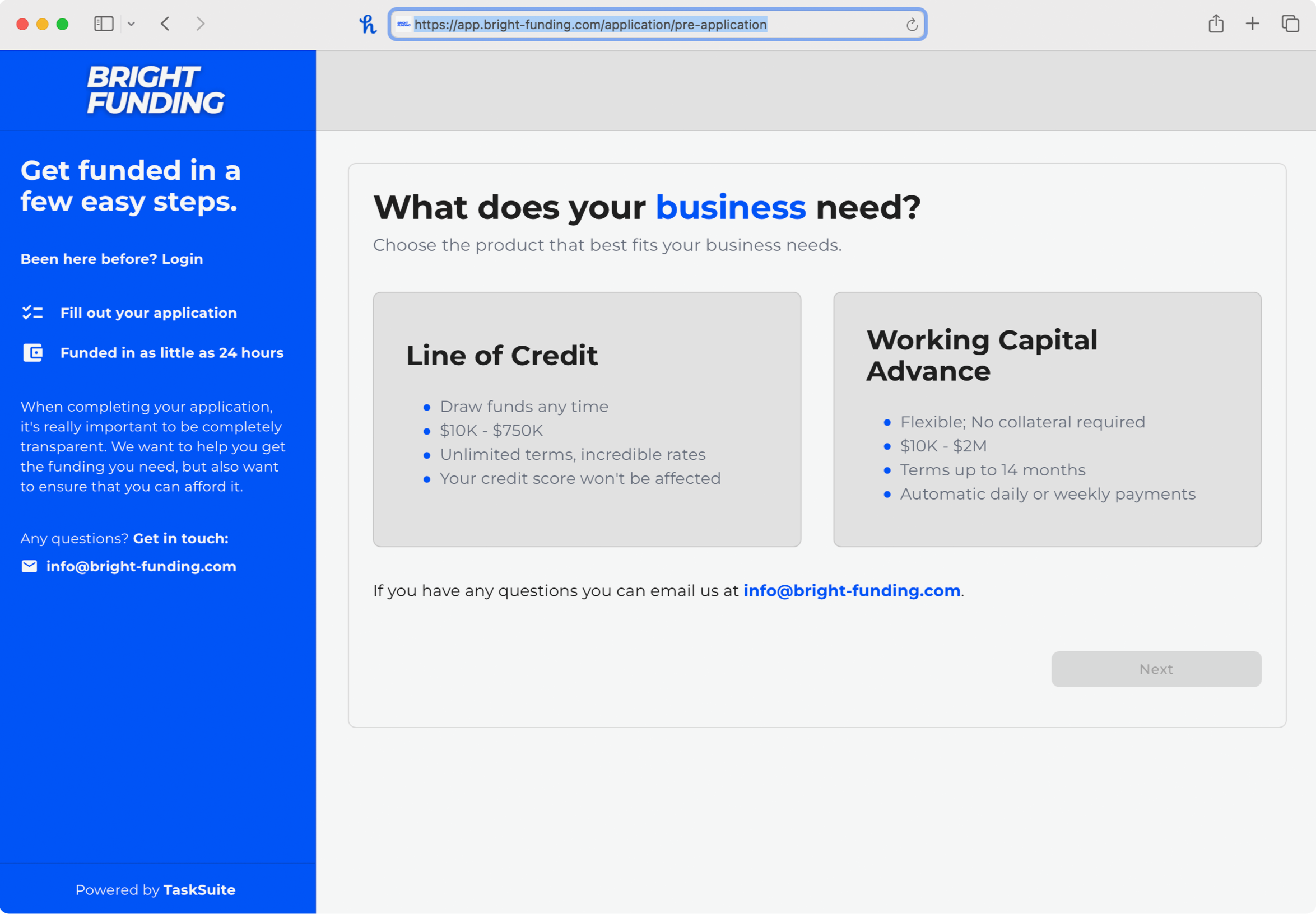

Simple, Streamlined Solutions.

We specialize in short-term working capital designed to keep your business running smoothly.

How Bright Funding Works.

Step 1: Apply in Minutes

Submit your application online or by email—just basic info to get started.

Step 2: Get a Decision Fast

Once we receive your file, our team underwrites and responds—usually within hours.

Step 3: Funding for All Business Types

Approved deals can be funded as soon as the same day. No drawn-out closings or hidden hoops.

Flexible Options.

No lengthy closings. No corporate red tape. Just clear, fast funding built around your needs.

FAQs

Let's Make Business Brighter.

No complicated forms.

No endless waiting.

Just simple funding.

Let’s make your next move the Bright one.

Fill out the form below for an instant quote.